Loss Aversion Bias

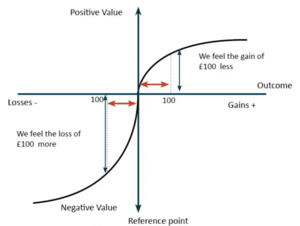

Loss aversion is a cognitive bias that describes the tendency for people to prefer avoiding losses over acquiring equivalent gains. In other words, the pain of losing is psychologically about twice as powerful as the pleasure of gaining. This concept is central to behavioral economics and decision-making research.

For example, consider that you are presented with two options. Option A: You receive $50 for sure. Option B: There is a 50% chance you can win $100, and a 50% chance you win nothing. Mathematically, the expected value for both options is $50, but due to loss aversion, people generally prefer the sure gain of $50, over the risk of potentially winning nothing in option B.

This bias can lead to irrational decisions in a variety of contexts, like finance and health care, where an individual might choose a less beneficial option to avoid the potential of loss. For instance, a person might hold onto a declining stock because they fear the loss that would come from selling it, even though they would likely be better off investing that money elsewhere.

Loss aversion is considered an important concept in prospect theory, which was developed by Daniel Kahneman and Amos Tversky in 1979. Prospect theory (see Figure 1) suggests that people make decisions based on the potential value of losses and gains rather than the final outcome, and that people evaluate these losses and gains using certain heuristics.