Inequality

Wealth is different from income as it already exists. However there is no wealth tax only income tax...

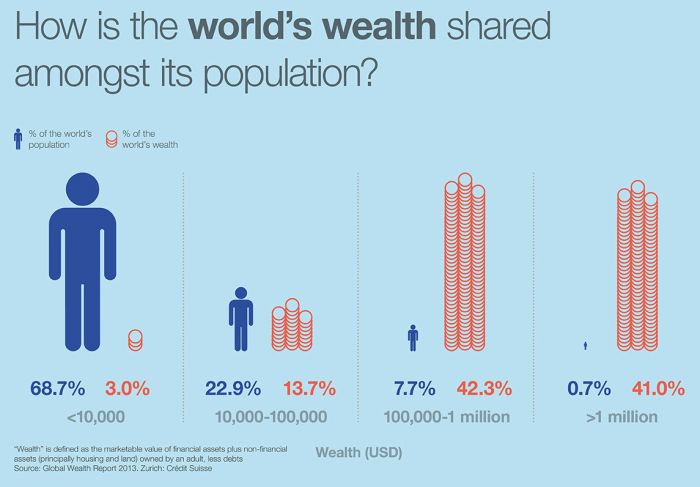

The image above divides the world's ~8bn people into four quarters based on the wealth they own. The poorest are to the left and as you descend to the right people become richer.

The big blue man on the left represents the poorest, encompassing 68.7% of people[1] and shows that they have less than $10,000. Let that sink in for a moment, the majority of the people on this planet live on less than 3% of its overall wealth (in red above). The next, blue person, represents the next quarter of people on the earth. This section owns $10,000-$100,000 in wealth which is around 23% of the population on earth. If you combine the largest and second largest blue people together you can see that 7.5 billion people i.e. 91.6% of people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth.

Tax rates

The majority of government taxes are based on income[2] not existing wealth. So someone like Jeff Bezos or Elon Musk might have a gajillion dollars in shares but as they havent been sold, there is no income and therefore no tax. Putting this aside for a moment, let's have a look at income taxes around the world.

Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher. There are two major issues here:

- Around the world the tax bracket levels of too early. The Laffer curve is often quoted here as higher tax can be a disincentive to work, there is some merit in this however modern analysis has found that the top of the curve should be 70% not 40% which is seen around the world[2].

- Tax havens[3]. As a wide range of leaks have revealed, even with a lower tax rate many individual entities move abroad to tax havens.

References

- ↑ United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this link on 10th February 2022..

- ↑ 2.0 2.1 https://treasury.gov.au/review/tax-white-paper/at-a-glance#:~:text=The%20major%20sources%20of%20state,of%20local%20government%20tax%20revenue.

- ↑ https://www.cbc.ca/news/offshore-tax-haven-leaks-panama-pandora-paradise-papers-1.6205447