Inequality: Difference between revisions

No edit summary |

No edit summary |

||

| Line 3: | Line 3: | ||

[[File:Top-1-percent.jpg|alt=Top-1-percent|thumb|Top-1-percent]] | [[File:Top-1-percent.jpg|alt=Top-1-percent|thumb|Top-1-percent]] | ||

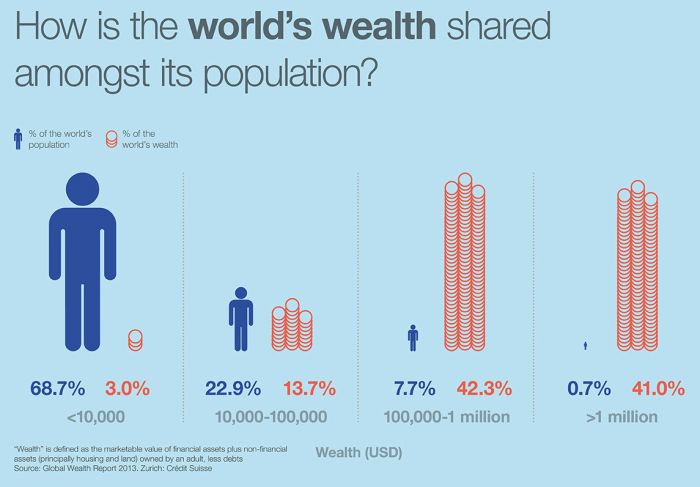

'''The big person on the left represents 68.7% of people on earth. It shows nearly 6 billion of the 8 billion on earth<ref>''United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this [https://population.un.org/wpp/ link] on 10th February 2022..''</ref> have less that $10,000.''' Let that sink in for a moment, the majority of the people on this planet live on less than 3% of its wealth (in red above). The next, smaller person, represent the lower amount of people on earth who have $10,000-$100,000m this equates to 22.99% of the population. So putting these figure together you can see that 7.5 billion people i.e. 91.6% fo people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth. | '''The big person on the left represents 68.7% of people on earth. It shows nearly 6 billion of the 8 billion on earth<ref>''United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this [https://population.un.org/wpp/ link] on 10th February 2022..''</ref> have less that $10,000.''' Let that sink in for a moment, the majority of the people on this planet live on less than 3% of its wealth (in red above). The next, smaller person, represent the lower amount of people on earth who have $10,000-$100,000m this equates to 22.99% of the population. So putting these figure together you can see that 7.5 billion people i.e. 91.6% fo people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth. | ||

=== Tax rates === | |||

The majority of government taxes are based on income<ref>https://treasury.gov.au/review/tax-white-paper/at-a-glance#:~:text=The%20major%20sources%20of%20state,of%20local%20government%20tax%20revenue.</ref> not existing wealth. So someone like Jeff Bezos or Elon Musk might have a gajillion dollars in shares but as they havent been sold, there is no income and therefore no tax. However, putting this aside lets have a look at income taxes around the world. | |||

Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher. | |||

'''References''' | '''References''' | ||

Revision as of 04:27, 10 February 2022

World inequality is initially difficult to grasp, but 🐻 with us. The image below seperates the world based on our wealth, poorest to the left, richest to the right....

The big person on the left represents 68.7% of people on earth. It shows nearly 6 billion of the 8 billion on earth[1] have less that $10,000. Let that sink in for a moment, the majority of the people on this planet live on less than 3% of its wealth (in red above). The next, smaller person, represent the lower amount of people on earth who have $10,000-$100,000m this equates to 22.99% of the population. So putting these figure together you can see that 7.5 billion people i.e. 91.6% fo people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth.

Tax rates

The majority of government taxes are based on income[2] not existing wealth. So someone like Jeff Bezos or Elon Musk might have a gajillion dollars in shares but as they havent been sold, there is no income and therefore no tax. However, putting this aside lets have a look at income taxes around the world.

Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher.

References

- ↑ United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this link on 10th February 2022..

- ↑ https://treasury.gov.au/review/tax-white-paper/at-a-glance#:~:text=The%20major%20sources%20of%20state,of%20local%20government%20tax%20revenue.