Survivorship Bias: Difference between revisions

mNo edit summary |

mNo edit summary |

||

| Line 4: | Line 4: | ||

Survivorship Bias is a logical error where we focus on the people or things that "''survived''" some process and inadvertently overlook those that did not because of their lack of visibility. This can lead to false conclusions (see '''Figure 2''') in several different areas, including the misinterpretation of success in business or the effectiveness of healthcare treatments, as the failures are ignored or forgotten.[[File:Survivorship Bias Diagram.png|alt=Survivorship Bias|thumb|'''Figure 2'''. Observation of survivors (as they are the only ones there!) leads to survivorship bias.]] | Survivorship Bias is a logical error where we focus on the people or things that "''survived''" some process and inadvertently overlook those that did not because of their lack of visibility. This can lead to false conclusions (see '''Figure 2''') in several different areas, including the misinterpretation of success in business or the effectiveness of healthcare treatments, as the failures are ignored or forgotten.[[File:Survivorship Bias Diagram.png|alt=Survivorship Bias|thumb|'''Figure 2'''. Observation of survivors (as they are the only ones there!) leads to survivorship bias.]] | ||

== | == Four more survivorship bias examples: == | ||

* '''Technology Trends''': People tend to focus on the winners of technological waves. Like Ford and the car industry in the early 1900s. Or Amazon and the internet in the 90s. This creates the impression that all companies that ride a big trend can be successful — like AI today. But in 1908, there were 253 car manufacturers. Only 4 of them survived. | * '''Technology Trends''': People tend to focus on the winners of technological waves. Like Ford and the car industry in the early 1900s. Or Amazon and the internet in the 90s. This creates the impression that all companies that ride a big trend can be successful — like AI today. But in 1908, there were 253 car manufacturers. Only 4 of them survived. | ||

* '''Stock Market Returns''': People love looking at Warren Buffett’s historical returns. And calculate how much they’d be worth if they invested in Berkshire 50 years ago. I like it too, not gonna lie. But this makes people expect Buffett-like returns when they invest. While stock market history is full of unsuccessful investors and funds. | * '''Stock Market Returns''': People love looking at Warren Buffett’s historical returns. And calculate how much they’d be worth if they invested in Berkshire 50 years ago. I like it too, not gonna lie. But this makes people expect Buffett-like returns when they invest. While stock market history is full of unsuccessful investors and funds. | ||

* '''Lottery Effect''': People focus on lottery winners. And forget millions who bought a ticket but didn’t get anything. So they keep buying lottery tickets. Even though winning chances are lower than getting struck by a lightning. | * '''Lottery Effect''': People focus on lottery winners. And forget millions who bought a ticket but didn’t get anything. So they keep buying lottery tickets. Even though winning chances are lower than getting struck by a lightning. | ||

* '''Cicero's Painting''': 2,000 years ago, the Roman philosopher and politician, Cicero, told the story of an atheist named Diagoras, who had been vocal in his non-belief about the gods. Those trying to convince Diagoras of the existence of higher powers showed him a series of painted tablets that portrayed a group of sailors who had prayed during a vicious storm and then survived the shipwreck. Diagoras looked at the paintings and replied, "I see those who were saved, but where are those painted who prayed and drowned?" | |||

== Two tips to avoid survivorship bias: == | == Two tips to avoid survivorship bias: == | ||

Revision as of 06:52, 7 December 2023

We pay attention to winners. And forget about losers. However, both sides of a story have an equal part to play in important lessons.

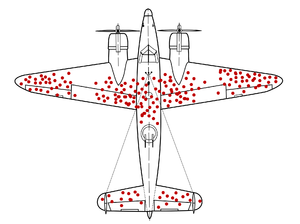

Mathematician Abraham Wald coined the term "Survivorship Bias" while working in a research group during Second World War. His group was working with the US army to reduce plane casualties, his team mapped out the most hit areas of the planes that survived the battles (see Figure 1), so the US army could strengthen those parts. But Wald realized something was wrong the planes that returned from the battle were survivors. That meant their analysis showed the least important parts of planes. But no planes returned with a damaged cockpit or engine. So the US army reinforced the unscathed parts and casualties dropped.

Survivorship Bias is a logical error where we focus on the people or things that "survived" some process and inadvertently overlook those that did not because of their lack of visibility. This can lead to false conclusions (see Figure 2) in several different areas, including the misinterpretation of success in business or the effectiveness of healthcare treatments, as the failures are ignored or forgotten.

Four more survivorship bias examples:

- Technology Trends: People tend to focus on the winners of technological waves. Like Ford and the car industry in the early 1900s. Or Amazon and the internet in the 90s. This creates the impression that all companies that ride a big trend can be successful — like AI today. But in 1908, there were 253 car manufacturers. Only 4 of them survived.

- Stock Market Returns: People love looking at Warren Buffett’s historical returns. And calculate how much they’d be worth if they invested in Berkshire 50 years ago. I like it too, not gonna lie. But this makes people expect Buffett-like returns when they invest. While stock market history is full of unsuccessful investors and funds.

- Lottery Effect: People focus on lottery winners. And forget millions who bought a ticket but didn’t get anything. So they keep buying lottery tickets. Even though winning chances are lower than getting struck by a lightning.

- Cicero's Painting: 2,000 years ago, the Roman philosopher and politician, Cicero, told the story of an atheist named Diagoras, who had been vocal in his non-belief about the gods. Those trying to convince Diagoras of the existence of higher powers showed him a series of painted tablets that portrayed a group of sailors who had prayed during a vicious storm and then survived the shipwreck. Diagoras looked at the paintings and replied, "I see those who were saved, but where are those painted who prayed and drowned?"

Two tips to avoid survivorship bias:

1. Look for silent evidence

The examples make it clear.

Success is loud.

But failure is silent.

So you’ll always hear success stories when you research business ventures or investments.

Don’t stop there.

Look for failures — or as Nassim Taleb calls it silent evidence.

It’s usually hidden in the data from losers.

Like the planes that never returned, or podcasts that never became a success.

Finding silent evidence will show you the real odds.

So you can take informed risks.

2. Pay attention to patterns

Joe Rogan, Warren Buffett, or J. K. Rowling…

We like hearing success stories.

But individual stories are dangerous.

They create the illusion that they are reproducible.

And cause people to ignore important factors — like timing and luck.

So instead, do as Wald did with the warplanes.

Look for patterns.

If you want to start a podcast, analyzing 20 successful podcasts will show you some patterns you wouldn’t see by analyzing only a few.

It’s the same with any business or product.

Ignore individual stories.

Pay attention to patterns.