Popular Delusions: Difference between revisions

(Created page with "alt=South Sea Macro Delusion|thumb|'''Figure 1'''. "Night wind hawkers" sold stock on the streets during the South Sea Bubble. (The Great Picture of Folly, 1720) '''Popular delusions are individual logical fallacies, cognitive biases and thought paradoxes that are so prevalent in society they exhibit as groupthink.''' Popular delusions are characterised by their fickle nature and rapid transmissibil...") |

mNo edit summary |

||

| (25 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

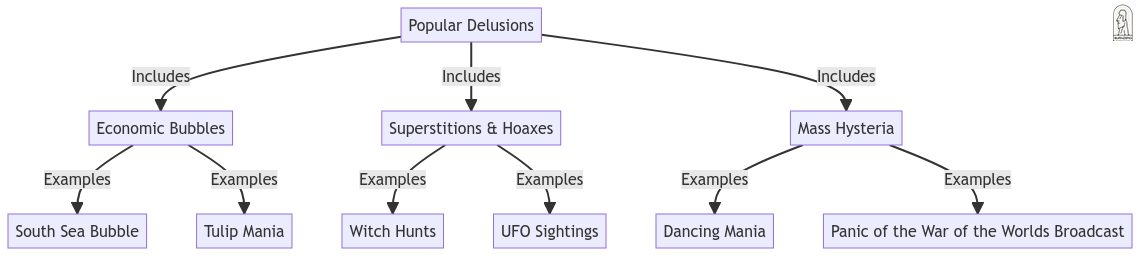

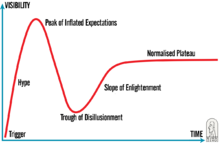

[[File: | <seo title="Popular Delusions and the Madness of Crowds" metakeywords="popular mass delusions, famous delusions, common delusions, popular delusions of crowds" metadescription="What are the most common delusions and why delusions happen"/>[[File:Common delusions.png|alt=Popular fallacies|center|Popular delusions]][[File:Popular Delusions Hype.png|alt=Popular Delusions Hype|thumb|'''Figure 1'''. Popular Delusions Gartner Hype Cycle|220x220px]]'''A delusion is a common false fixed belief that is not amenable to change in light of conflicting evidence.''' '''They exhibit in society as ideas or cultural fads that become transiently popular'''<ref>'''The Effects of Twitter Sentiment on Stock Price Returns''' Gabriele Ranco,Darko Aleksovski ,Guido Caldarelli,Miha Grčar,Igor Mozetič Published: September 21, 2015 https://doi.org/10.1371/journal.pone.0138441</ref>. Historically, they follow a [[Hype cycles|hype cycle]] (see '''Figure 1'''), starting with a trigger then moving rapidly into a hype phase at which point they cause frantic activity of crowds such as the [[wikipedia:South_Sea_Company|South Sea Bubble]] (see '''Figure 2'''), [[wikipedia:Tulip_mania|Tulip Mania]] or [[wikipedia:Witch-hunt|Witch Mania]]. Today popular delusions have become ever more transmissible via memes and the [[Advertising|advertising industry]]. <div class="res-img"></div>[[File:South Sea Macro Delusion.jpg|alt=South Sea Macro Delusion|thumb|'''Figure 2'''. [[Night Wind Hawkers]] sold stock on the streets during the South Sea Bubble. (The Great Picture of Folly, 1720)]]Popular delusions can have significant impacts on society and individuals. They can lead to irrational behaviors, poor decision-making, and in some cases, can result in harm or injustice. Understanding and recognizing these delusions can help individuals and societies make more informed and rational decisions. | ||

''' | |||

It's important to note that what may be considered a "''delusion''" can be subjective and may vary across different cultures and societies. What one group considers a delusion, another group may consider a deeply held belief or tradition. Therefore, the term should be used with caution and understanding of its potential cultural implications. | |||

=== | == History == | ||

=== 1637 - Tulip Mania === | |||

* In the Netherlands, tulip bulbs became a luxury item and status symbol, leading to wildly speculative and ultimately unsustainable market prices. | |||

=== 1719-1720 - The Mississippi Bubble === | |||

* In France, John Law's Mississippi Company tied to colonial trade became the center of a speculative bubble, which burst and ruined many investors. | |||

=== 1720 - The South Sea Bubble === | |||

* In England, the South Sea Company's promise of trade with South America led to a frenzy of investment and speculation, ending in financial disaster. | |||

=== 1840s - The Railway Mania === | |||

* In Britain, excessive speculation in rail transport led to a bubble that saw massive investments in railways, many of which were neither needed nor completed. | |||

=== 1920s - Florida Real Estate Bubble === | |||

* Intense speculation in Florida land during the 1920s, partly due to the burgeoning automobile's influence on tourism and mobility, led to a bubble that burst devastatingly in 1926. | |||

=== 1929 - Stock Market Crash === | |||

* Over-speculation and leverage in the stock market led to a dramatic crash in 1929, contributing to the Great Depression. | |||

=== 1980s - Japanese Asset Price Bubble === | |||

* Excessive speculation in real estate and stock prices in Japan during the late 1980s led to a bubble that burst in the early 1990s, leading to a long period of economic stagnation. | |||

=== 1990s - Dot-com Bubble === | |||

* Exuberance over internet-related businesses led to inflated stock prices and a bubble that burst around 2000, causing significant financial losses. | |||

=== 2007-2008 - Global Financial Crisis === | |||

* Subprime mortgage lending and complex financial products created a housing bubble that burst, leading to a severe international banking crisis and recession. | |||

'''References'''<references /> | '''References'''<references /> | ||

Latest revision as of 01:08, 7 November 2023

A delusion is a common false fixed belief that is not amenable to change in light of conflicting evidence. They exhibit in society as ideas or cultural fads that become transiently popular[1]. Historically, they follow a hype cycle (see Figure 1), starting with a trigger then moving rapidly into a hype phase at which point they cause frantic activity of crowds such as the South Sea Bubble (see Figure 2), Tulip Mania or Witch Mania. Today popular delusions have become ever more transmissible via memes and the advertising industry.

Popular delusions can have significant impacts on society and individuals. They can lead to irrational behaviors, poor decision-making, and in some cases, can result in harm or injustice. Understanding and recognizing these delusions can help individuals and societies make more informed and rational decisions.

It's important to note that what may be considered a "delusion" can be subjective and may vary across different cultures and societies. What one group considers a delusion, another group may consider a deeply held belief or tradition. Therefore, the term should be used with caution and understanding of its potential cultural implications.

History

1637 - Tulip Mania

- In the Netherlands, tulip bulbs became a luxury item and status symbol, leading to wildly speculative and ultimately unsustainable market prices.

1719-1720 - The Mississippi Bubble

- In France, John Law's Mississippi Company tied to colonial trade became the center of a speculative bubble, which burst and ruined many investors.

1720 - The South Sea Bubble

- In England, the South Sea Company's promise of trade with South America led to a frenzy of investment and speculation, ending in financial disaster.

1840s - The Railway Mania

- In Britain, excessive speculation in rail transport led to a bubble that saw massive investments in railways, many of which were neither needed nor completed.

1920s - Florida Real Estate Bubble

- Intense speculation in Florida land during the 1920s, partly due to the burgeoning automobile's influence on tourism and mobility, led to a bubble that burst devastatingly in 1926.

1929 - Stock Market Crash

- Over-speculation and leverage in the stock market led to a dramatic crash in 1929, contributing to the Great Depression.

1980s - Japanese Asset Price Bubble

- Excessive speculation in real estate and stock prices in Japan during the late 1980s led to a bubble that burst in the early 1990s, leading to a long period of economic stagnation.

1990s - Dot-com Bubble

- Exuberance over internet-related businesses led to inflated stock prices and a bubble that burst around 2000, causing significant financial losses.

2007-2008 - Global Financial Crisis

- Subprime mortgage lending and complex financial products created a housing bubble that burst, leading to a severe international banking crisis and recession.

References

- ↑ The Effects of Twitter Sentiment on Stock Price Returns Gabriele Ranco,Darko Aleksovski ,Guido Caldarelli,Miha Grčar,Igor Mozetič Published: September 21, 2015 https://doi.org/10.1371/journal.pone.0138441