Inequality: Difference between revisions

No edit summary |

mNo edit summary |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

[[File:World inequality.jpg|alt=World inequality|center|700x700px|World inequality]] | [[File:World inequality.jpg|alt=World inequality|center|700x700px|World inequality]] | ||

[[File:Top-1-percent.jpg|alt=Top-1-percent|thumb|''“Earth provides enough to satisfy every man's needs, but not every man's greed.”''― '''Mahatma Gandhi''']] | [[File:Top-1-percent.jpg|alt=Top-1-percent|thumb|'''''Figure 1'''. “Earth provides enough to satisfy every man's needs, but not every man's greed.”''― '''Mahatma Gandhi''']] | ||

''' | '''The majority of the people (68.7%) on this planet live on less than 3% of its overall wealth.''' This is depicted in the image above, where the world's ~8bn people are divided into four quarters based on the wealth they own. The poorest earn less than $10k a year are to the left encompassing 68.7% of all people<ref>''United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this [https://population.un.org/wpp/ link] on 10th February 2022..''</ref>, then as you move to the right people become richer. | ||

The | The next, blue person, represents the next quarter of people on the earth. This section owns $10,000-$100,000 in wealth which is around 23% of the population on earth. If you combine the largest and second largest blue people together you can see that 7.5 billion people i.e. 91.6% of people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth. | ||

=== Tax rates === | |||

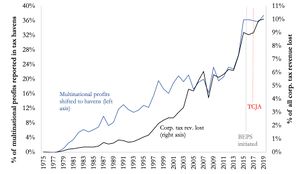

[[File:Tax havens.jpg|alt=Tax havens|thumb|'''Figure 2'''. Since the 70's tax havens have been becoming increasingly popular for corporations<ref>United Nations University. WIDER Working Paper 2022. Global profit shifting, 1975–2019. Ludvig Wier and Gabriel Zucman. Accessed on 14th February 2023 via: https://gabriel-zucman.eu/files/WZ2022WIDER.pdf</ref>.]] | |||

The majority of income earned on this planet goes to [[Corporation|corporations]]. Ideally, as most countries are a democracy, governments should then tax corporations and redistribute some of the wealth to the people in the country that the money is earned. This was the case up until the 70's where due to globalisation many corporations, due to [[Fiduciary Duty|fiduciary duty]], now use registered tax havens to reduce their tax burden ('''Figure 2''') | |||

The rest of our economy's wealth goes to individuals however the majority of government taxes are based on income<ref name=":0">https://treasury.gov.au/review/tax-white-paper/at-a-glance#:~:text=The%20major%20sources%20of%20state,of%20local%20government%20tax%20revenue.</ref> not existing wealth. So someone like Jeff Bezos or Elon Musk might have a hundreds of billions of dollars in shares but as they havent been sold, there is no income and therefore no tax. Putting this aside for a moment, let's have a look at income taxes around the world. | |||

Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher. There are two major issues here: | Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher. There are two major issues here: | ||

| Line 16: | Line 17: | ||

=== Inequality and the Environment === | === Inequality and the Environment === | ||

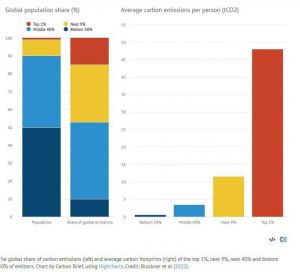

One of the most common arguments for not doing anything is "China and India have 2 billion plus people, why should we do anything?". The richest 10% on earth are responsible for 52% of global emissions, and the richest 1% are responsible for 15. If you would like to see who specifically is responsible, have a look at our Ecocidal Criminals | [[File:The one percent.jpg|alt=The one percent|thumb|'''Figure 3'''. The richest 10% on earth are responsible for 52% of global emissions]] | ||

One of the most common arguments for not doing anything is "China and India have 2 billion plus people, why should we do anything?". The richest 10% on earth are responsible for 52% of global emissions, and the richest 1% are responsible for 15. If you would like to see who specifically is responsible, have a look at our article on [[Ecocidal Criminals|ecocidal criminals]]. | |||

'''References''' | '''References''' | ||

Latest revision as of 22:20, 13 February 2023

The majority of the people (68.7%) on this planet live on less than 3% of its overall wealth. This is depicted in the image above, where the world's ~8bn people are divided into four quarters based on the wealth they own. The poorest earn less than $10k a year are to the left encompassing 68.7% of all people[1], then as you move to the right people become richer.

The next, blue person, represents the next quarter of people on the earth. This section owns $10,000-$100,000 in wealth which is around 23% of the population on earth. If you combine the largest and second largest blue people together you can see that 7.5 billion people i.e. 91.6% of people earn less than $100,000. What's very revealing is that around 8.4% of the world's wealth, 41% belongs to the rest of the lucky 0.5 billion or 500 million people on earth.

Tax rates

The majority of income earned on this planet goes to corporations. Ideally, as most countries are a democracy, governments should then tax corporations and redistribute some of the wealth to the people in the country that the money is earned. This was the case up until the 70's where due to globalisation many corporations, due to fiduciary duty, now use registered tax havens to reduce their tax burden (Figure 2)

The rest of our economy's wealth goes to individuals however the majority of government taxes are based on income[3] not existing wealth. So someone like Jeff Bezos or Elon Musk might have a hundreds of billions of dollars in shares but as they havent been sold, there is no income and therefore no tax. Putting this aside for a moment, let's have a look at income taxes around the world.

Most income tax rates are progressive meaning someone earning <$10,000 should, quite rightly only pay a small percentage of their income to the government whereas someone in the next bracket say $40,000 should pay a slightly higher tax and someone above this would pay even higher. There are two major issues here:

- Around the world the tax bracket levels of too early. The Laffer curve is often quoted here as higher tax can be a disincentive to work, there is some merit in this however modern analysis has found that the top of the curve should be 70% not 40% which is seen around the world[3].

- Tax havens[4]. As a wide range of leaks have revealed, even with a lower tax rate many individual entities move abroad to tax havens.

Inequality and the Environment

One of the most common arguments for not doing anything is "China and India have 2 billion plus people, why should we do anything?". The richest 10% on earth are responsible for 52% of global emissions, and the richest 1% are responsible for 15. If you would like to see who specifically is responsible, have a look at our article on ecocidal criminals.

References

- ↑ United Nations Department of Department of Economic and Social Affairs:World Population Prospects published in 2019, accessed via this link on 10th February 2022..

- ↑ United Nations University. WIDER Working Paper 2022. Global profit shifting, 1975–2019. Ludvig Wier and Gabriel Zucman. Accessed on 14th February 2023 via: https://gabriel-zucman.eu/files/WZ2022WIDER.pdf

- ↑ 3.0 3.1 https://treasury.gov.au/review/tax-white-paper/at-a-glance#:~:text=The%20major%20sources%20of%20state,of%20local%20government%20tax%20revenue.

- ↑ https://www.cbc.ca/news/offshore-tax-haven-leaks-panama-pandora-paradise-papers-1.6205447