Status Quo Bias

Our brains don't like to expend energy, so we are hardwired to avoid tasks that cause us to change our mindset or that lead to cognitive burden. This leads us to have a cognitive bias towards sticking with the status quo...

We are resistant to change, as we fear we’ll regret actively making choices (when doing nothing is also a “choice”). The Status Quo Bias can, for example, lead to “loss aversion bias” – compelling us to focus on not losing. When in doubt, we essentially tell ourselves to do nothing.

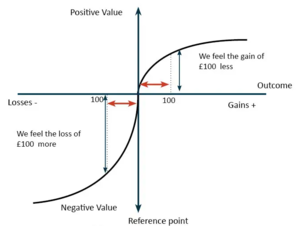

The Status Quo Bias is something that has been observed in numerous scientific studies[1][2]. In one study, it was found that losses are almost twice as psychologically harmful as gains are beneficial. In other words, most people feel twice as much psychological pain from losing US$100 as pleasure from gaining US$100 (See Figure 2). This bias means that people are reluctant to take risks by giving away what they possess in favour of something that “might” be more profitable to them in the future.

In another study, researchers found that they could predict an individual's level of success in the workplace based on whether or not they used the default browser that came with their phone. Those who went to the length of installing a different browser because they knew it would be better, were more likely to challenge assumptions, actively seek out solutions, and be more successful in their careers.

Some personality traits could influence someones propensity to stick with the status quo. If someone is open and curious about new things, less averse to taking risks and have a strong sense of duty (conscientiousness) they may be slightly less affected by this bias.

References

- ↑ Status quo bias in decision making. Journal of Risk and Uncertainty, 1, 7-59. Samuelson, W., & Zeckhauser, R. J. (1988).

- ↑ Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. Kahneman, D.; Knetsch, J. L.; Thaler, R. H. (1991). Journal of Economic Perspectives. 5 (1): 193–206. doi: https://www.aeaweb.org/articles?id=10.1257/jep.5.1.193